In a rapidly evolving banking landscape, financial institutions face a multitude of challenges in software testing. Banks must rigorously assess an array of complex systems, including core banking platforms, mobile banking applications, and payment processing systems, all while maintaining the utmost security and compliance with many regulations.

The Challenge:

Our client, a prominent Vietnamese bank, encountered several difficulties stemming from their manual testing procedures. Manual testing proved to be time-consuming, expensive, and a significant impediment to keeping up with the breakneck pace of innovation in the banking industry. To address this challenge, they turned to a trusted digital partner in the field of automation testing: BnK Solution.

The Solution:

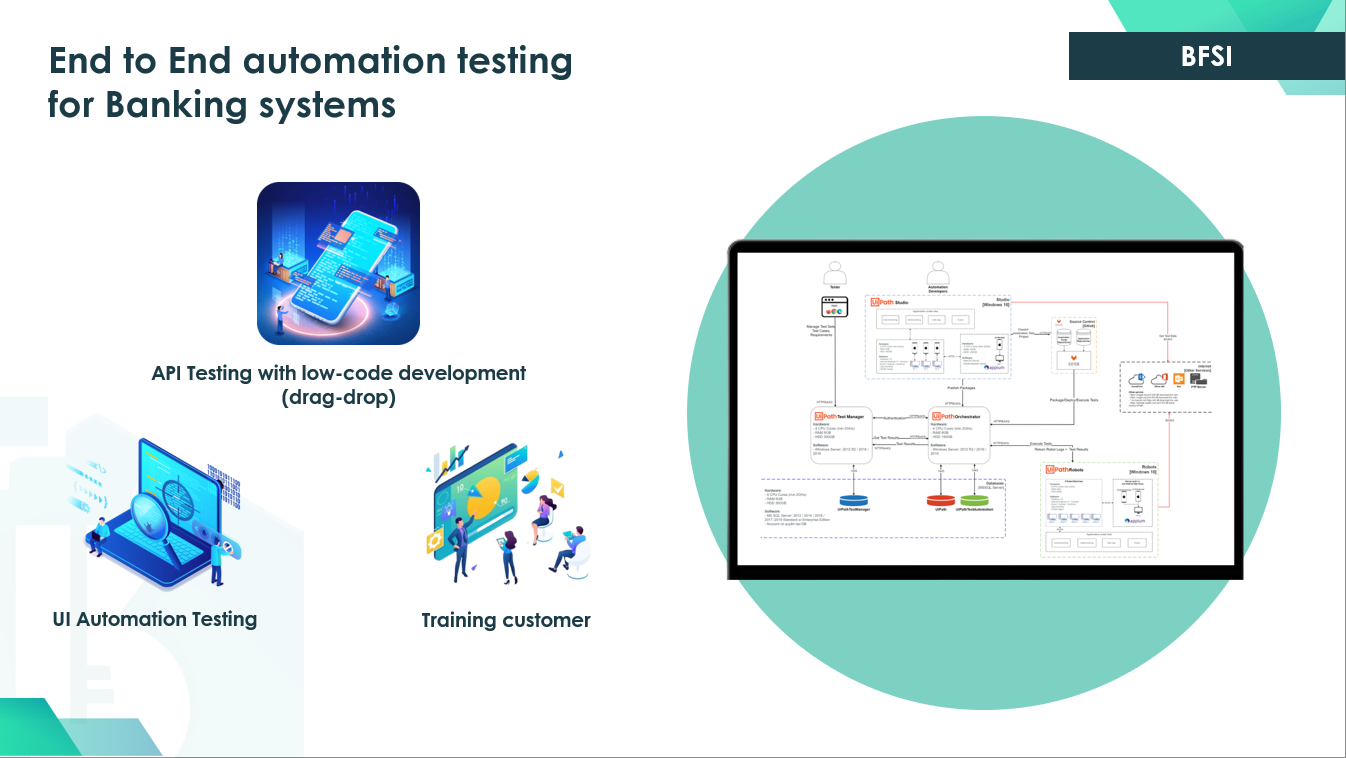

BnK Solution's response to these challenges involved a comprehensive suite of cutting-edge RPA technologies and tools, including:

API Testing with UiPath Studio: This advanced approach allowed for thorough API testing with the help of UiPath Studio, streamlining the process and enhancing its accuracy. Furthermore, BnK Solution also harnessed the power of UiPath Robots, incorporating it into the solution to automate complex tasks, reducing the margin for error.

UI Automation Testing with UiPath Test Manager: BnK Solution integrated UiPath Test Manager to bolster their UI automation testing. This technology empowered the bank to evaluate its software systems from the end-user perspective, ensuring a seamless and user-friendly experience.

Low-Code Device Range Optimization: Finally, applying low-code device range optimization simplified the process even further, minimizing complexity while broadening the scope of their testing efforts.

The Outcomes:

The transformation wrought by BnK Solution's automation testing was quantifiable and impactful. The bank experienced a:

Significant Cost Reduction: Testing expenses were significantly reduced, with a specific percentage drop that streamlined resource allocation.

Enhanced Testing Precision: Automation led to fewer production system bugs, resulting in a precise and reliable banking software ecosystem.

Accelerated Time to Market: Testing time and costs were drastically reduced, allowing for swift product and service launches driven by UiPath Orchestrator's capabilities.

Conclusion:

Automation testing is more than just a buzzword; it's the cornerstone of modern banking software excellence. The benefits it could yield for banks are substantial, from cost savings to improved accuracy and faster market entry. And at BnK Solution, we are proud to position ourselves at the forefront of this transformation.

If you're ready to elevate your banking operations, streamline your processes, and ensure compliance, contact BnK Solution today. Our expertise and innovative solutions can revolutionize your testing procedures, ensuring you're always ahead in the fast-paced banking world.

.png)

.png)

.png)

.png)