In the banking sector, traditional payroll reconciliation has become a time-consuming, potentially risky process and requires a lot of human resources to implement. However, with the development of information technology, especially intelligent artificial intelligence, BnK Solution has successfully researched and developed a product called PAI to help automate and optimize the process of reconciling payroll documents in the banking world

Let's see what PAI can do!

Potential risks in the traditional payroll reconciliation process

Most banks still use the traditional process of document reconciliation and procedures. However, this approach often has inadequacies and potential risks:

Time consuming: The manual reconciliation of documents and procedures often takes a long time. The process of checking, validating, and entering data from documents into the system can reduce employee productivity and prolong transaction time with customers.

Errors and Mistakes: Manual processing can cause errors and confusion during data entry and stakeholder reconciliation. This can lead to erroneous, incomplete, or inaccurate information, creating difficulties and risks for both the bank and the customer.

Security risks: Manual processes can create security risks for customer information. For example, when documents and sensitive information are passed through many hands, there is a potential for theft or loss. This threatens the information security of customers.

Difficulty in searching and processing information: When information is stored in paper form, finding, retrieving, and processing information becomes more difficult than using electronic systems. This can interfere with the work process and reduce employee performance.

Increased costs and dependence on human resources: Performing manual document reconciliation and procedures requires great concentration and effort from employees. This means increased costs and reliance on human resources while reducing the bank's flexibility and scalability.

Payroll is the active conduct of business in nearly all businesses and is one of the main services businesses often use at banks. With the specialist skill of working with documents, this job still requires a lot of personnel and prolongs transaction processing time. If the bank cannot organize payroll well, it may lose potential customers by failing to ensure a good service experience and work efficiency. Especially this is a business that usually focuses only on a few times of the month, such as the beginning of the month or the end of the month.

To solve this problem, banking businesses must find an effective solution to replace traditional document reconciliation with advanced technologies. A notable product in this field is PAI (Payroll Artificial Intelligence).

BnK's Payroll Reconciliation Solution

Overview of PAI solution in payroll reconciliation

Currently, some banks have been experimenting with OCR technology for payroll. Traditional OCR (Optical Character Recognition) technology is widely used in data collation and classification but still has certain limitations. The extraction of information through OCR can only be done according to the available forms, but in practice, when comparing salary expenditures at the Bank, documents, procedures, and data generally have various forms and different ways of expression. Therefore, the accuracy and ability to classify and extract information documents of traditional OCR are also limited, leading to the failure to achieve the expected efficiency.

PAI (Payroll Artificial Intelligence) is an advanced technology product that was researched and developed by BnK Solution. PAI's foundation technology includes a combination of OCR technology and artificial intelligence (AI - Artificial Intelligence), which automates the payroll processing process and completely replaces manual document reconciliation.

OCR technology reads the information on the document. Input data includes payroll and salary payment documents (Request for salary payment transaction, list credit, payment order/payment authorization, accounting slip, etc.) with PDF format images and Excel files.

AI technology with the ability to read and understand information extracted from OCR to collate and check data automatically according to the requirements of payroll business specifications, even in documents that AI has not been trained through.

With BnK PAI, businesses can:

Speed up work processing and minimize wasted time due to manual document reconciliation.

Process large amounts of data with optimal time and high accuracy.

Minimize the risk of errors and risks of loss in the process of checking and comparing payroll data.

Easily manage, monitor, and secure information.

Reduce investment costs in hiring personnel and other resource costs.

Solve SLA problems on time when at peak times.

So, why is PAI reliable in the eyes of businesses in the banking and finance industry? Find out below.

PAI is designed for the Banking industry with the following key features:

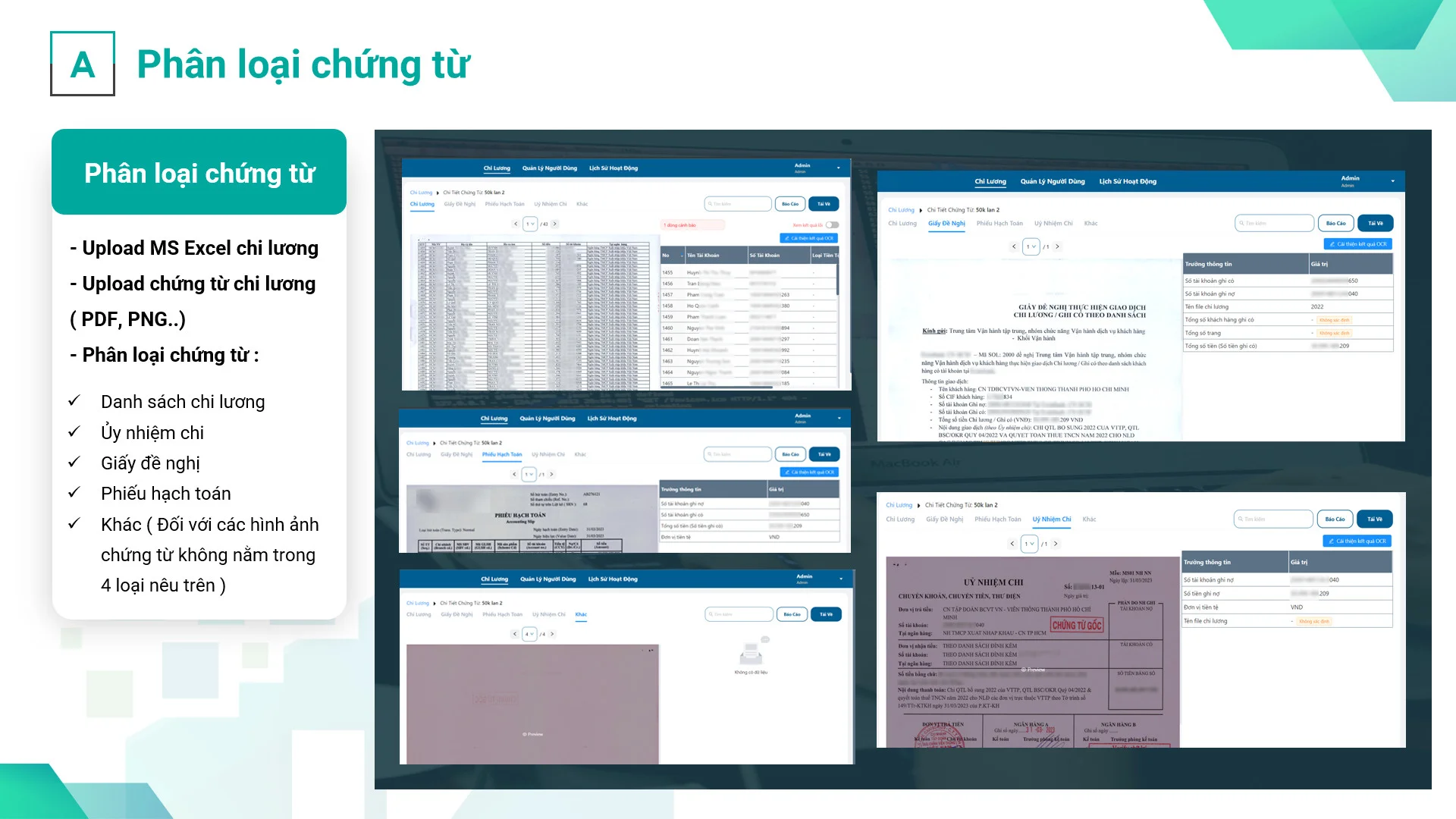

a. Document classification

The system can automatically classify input documents to check the completeness of the set of documents and serve as a basis to check that each type of document has all the necessary information.

b. Render and report OCR results

The system can extract meaningful information fields and synthesize and report results based on OCR combined with artificial intelligence.

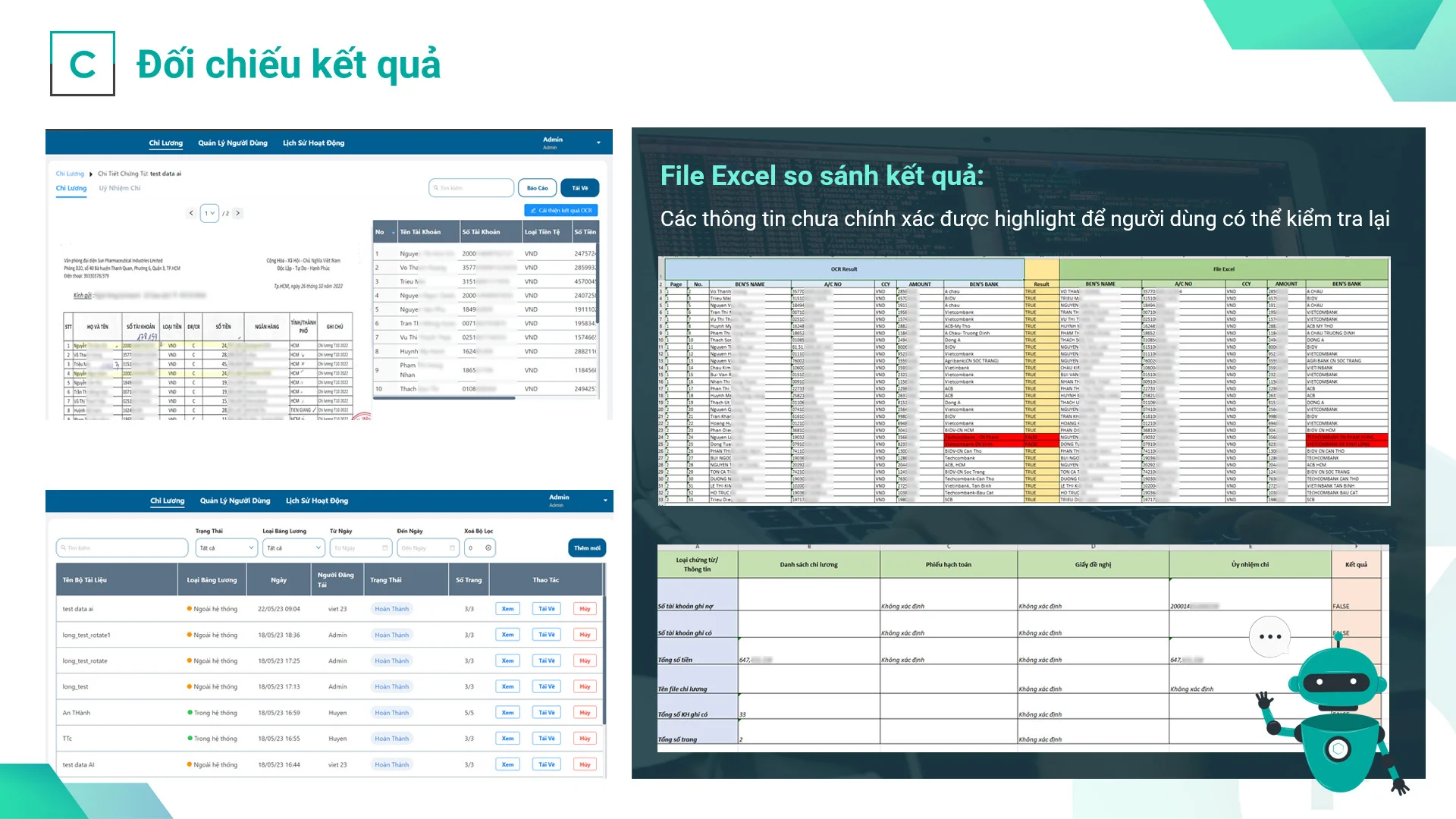

c. Compare results

The system will compare between the original paper document and the electronic document (Excel), showing the differences so that users can identify and check again. Compared to traditional manual checking, this comparison is designed to be convenient, highly accurate, and takes very little time to perform.

d. Manage Users: Granular user management and permissions.

e. Operation history: Review the history to serve the post-audit and audit work later.

f. System integration: Ability to integrate with RPA and other systems.

Payroll automation - the perfect combination of RPA and PAI

RPA is applied to process automation in banking and finance enterprises. The combination of RPA and PAI is a perfect solution to automate the payroll process at the bank. From there, creating a seamless process from business input to the sales department, customer service, back office, and banks' automatic payroll system is possible.

.png)

.png)

.png)

.png)